Who Needs Cyber Insurance?

In short – Everyone!

For the past few years the media has been reporting large scale attacks such as Yahoo, AirBnB, LinkedIn, Myspace and a long list of others. In reality between 40% to 60% of all cyber attacks on Australian businesses are targeted at small to medium sized companies. Reports suggest this is due to a few important factors but a lack of security procedures and lower levels of employee risk awareness seem to be the major ones.

PwC found 65 per cent of Australian organisations experienced cybercrime in the last 24 months with more than one in 10 reporting losses of more than $1 million (compared to the global average of 32 per cent).

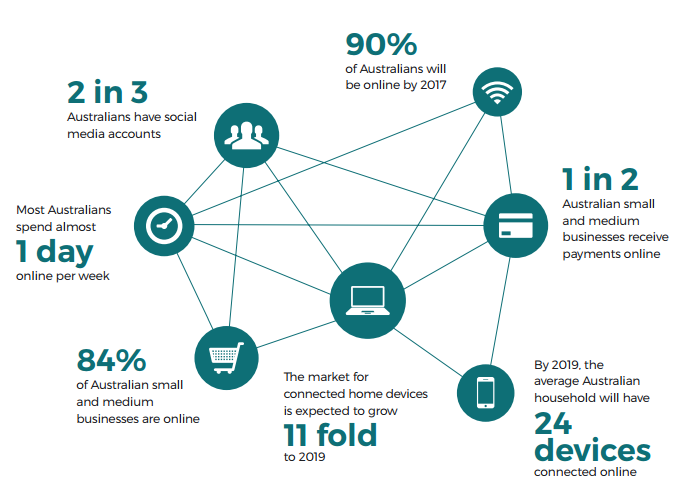

When you consider that 84% of Australian small and medium businesses are online and 1 in 2 are receiving payments online, Australia is a very attractive target for the would-be cyber criminal.

From Australian Cyber Security Strategy

Check out this short video from the National Insurance Brokers Association (NIBA) which succinctly summarizes who needs cyber insurance and why.

The 5 industries with the highest recorded amount of cyber-attacks 2015 – 2016:

1. Healthcare

2. Manufacturing

3. Financial Services

4. Government

5. Transportation

According to the 2016 IBM X-Force Cyber Security Intelligence Index — which reports more than 100 million healthcare records were breached last year. The IBM report is based on data they have collected from thousands of network devices they monitor in over 100 countries.

Between July 2015 and June 2016, CERT Australia – the main point of contact for cyber security issues affecting Australian businesses – responded to 14,804 cyber security incidents, 418 of which involved systems of national interest and critical infrastructure.

PwC Australia national cyber leader Steve Ingram, who previously headed fraud and security management for the Commonwealth Bank, says cyber attacks happen all the time. “It’s prolific,” he says

Here is another great cyber insurance summary from the KnowRiskNetwork.

Conclusion

In the past, business leaders adamantly avoided talking about cyber security processes or breaches for fear of reputational damage and legal fallout. We are slowly seeing more businesses who are not reluctant to talk about their cyber security hurdles and recognize the overall business risk not simply an IT risk.

Help protect your business with cyber insurance.

Comments

Not found any comments yet.